Since 2022, I have been independently developing systematic trading strategies across equities, ETFs, and cryptocurrencies. My work spans the full quantitative pipeline from data ingestion, cleaning, and feature engineering to signal construction, risk modeling, and robust backtesting using Python.

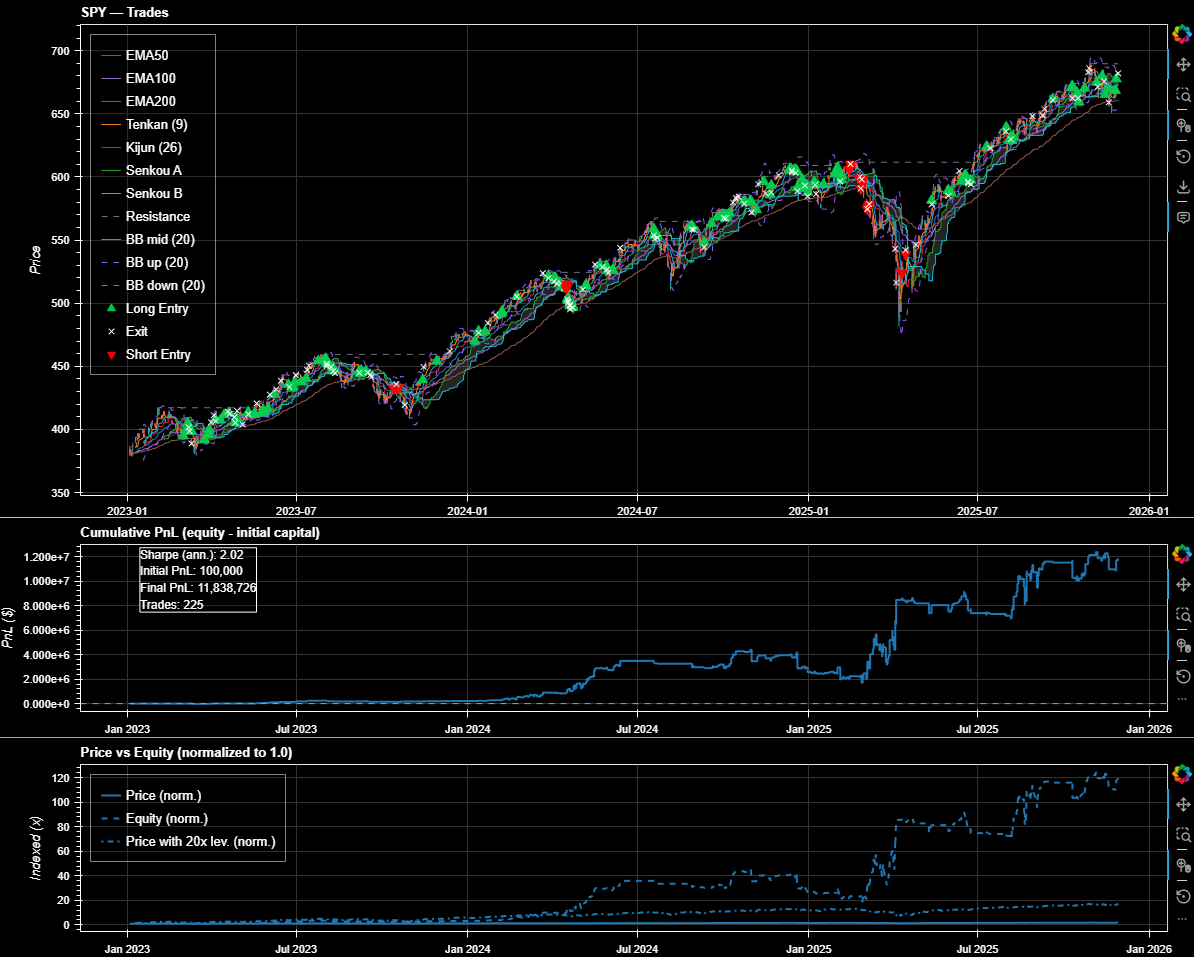

I build models operating on multiple time horizons, including intraday/day trading algorithms, swing and intra-week strategies, and long-term investment systems. These strategies combine market-structure features, technical indicators, volatility measures, and pattern dynamics with integrated risk controls such as position sizing rules, volatility targeting, and drawdown constraints.

I also design custom algorithmic strategies for individual investors, translating quantitative concepts into practical and reliable rule-based investment systems tailored to different risk profiles and time horizons.

Reinforcement learning

Backtesting & risk analysis

Equity Long/Short

Portfolio optimization

Signal engineering